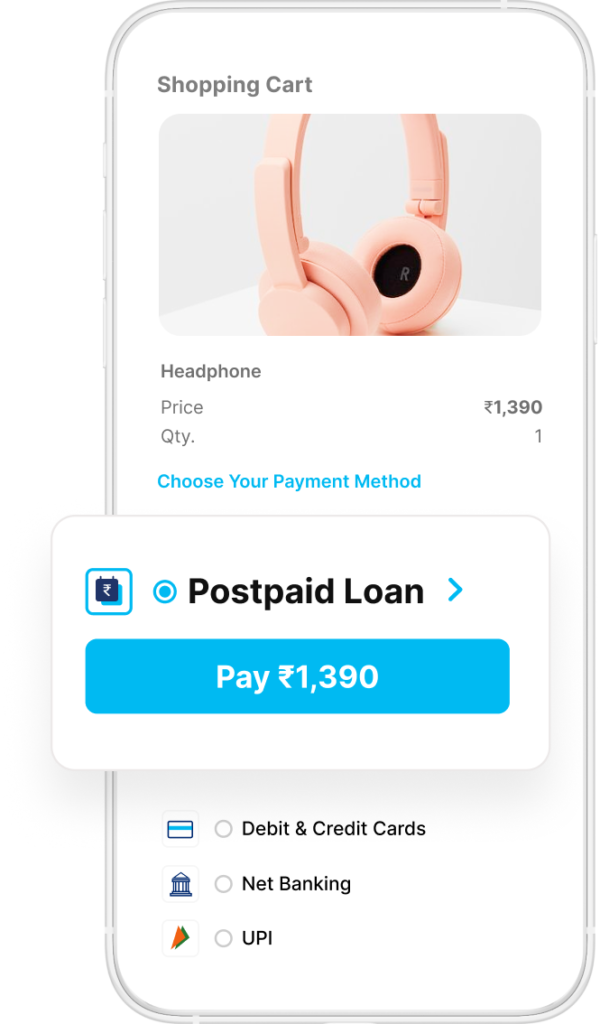

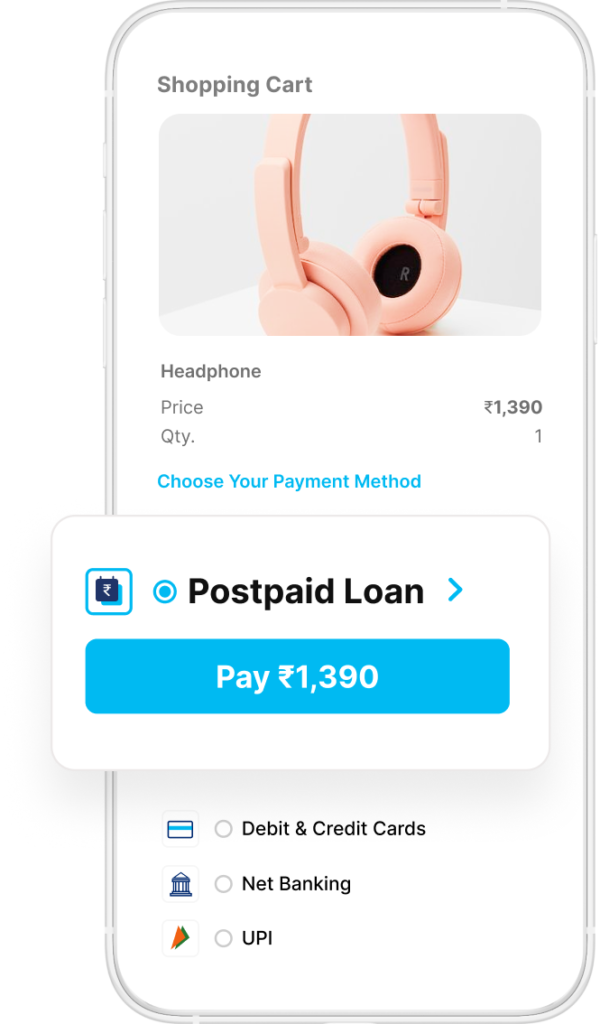

Paytm Postpaid is a credit service offered within Paytm that allows users to make purchases up to a certain limit and then pay back the amount over a flexible timeframe.

Having a higher Paytm Postpaid limit can be very useful as it provides more purchasing power and financial flexibility.

This guide will take you through the key steps involved in checking your current limit as well as increasing it.

Paytm Postpaid

Paytm Postpaid works similarly to a credit card but is integrated within your Paytm wallet and app.

Some key features include:

- Flexible credit limit – Limit is assigned based on your financial profile

- Interest-free period – Up to 30 days for repayment depending on when statement is generated

- Easy application – Instant digital approval process based on internal analytics

- Wide applicability – Can be used to pay merchants, send money, pay bills etc.

Importance of Increasing Your Paytm Postpaid Limit

Here are some major benefits of increasing your Paytm Postpaid limit:

- Make higher value purchases and payments

- Manage monthly expenses more conveniently

- Avail greater financial flexibility for needs like travel, shopping etc.

- Strengthen your credit profile by using and repaying higher credits

Checking Your Current Paytm Postpaid Limit

Your current Postpaid limit can be checked directly within the Paytm app:

- Open the latest version of the Paytm app on your device.

- Go to the Postpaid section.

- Check the limit shown at the top or scroll down and check account details.

The limit displayed here is what you currently have available for Postpaid spending.

Factors That Determine Your Paytm Postpaid Limit

Paytm uses sophisticated analytics based on multiple factors to determine your credit limit.

These include:

- Credit score – higher scores mean higher limits

- Paytm usage – regular transactions and repayments help increase limit

- Income – salary slips and total earnings impact limit assigned

- Existing loans – type, tenure etc. are evaluated

- Spending patterns – consistent monthly expenditures add stability for higher limits

So improving these factors can help increase the chances of getting an enhanced Postpaid limit.

Related: (3) 100% सफल बहतरीन बिज़नस उद्योग | (3) 100% Successful Best Business Industry

How To Increase Your Paytm Postpaid Limit: Step-By-Step

If you need a higher Paytm Postpaid limit, here is a step-by-step process to request an increase:

Check Eligibility

First ensure you meet the usage criteria:

- Active Paytm user for at least 6 months

- Timely repayments and good credit score

- KYC completed with necessary documents submitted

Link Your KYC

Link documents like:

- PAN Card

- Aadhar Card

- Voter ID

- Driving License

This builds stability for higher limits.

Increase Usage and Repayment

- Use Paytm Postpaid regularly for at least 3-4 months before requesting increase

- Ensure timely repayments as per statement generation

Maintain a Good Credit Score

- Pay all credit bills and loans on time

- Avoid high utilization of credit limit on cards

- Check credit report and fix any errors

Regularly Update the App

This allows Paytm to re-evaluate eligibility with latest data.

Link Multiple Bank Accounts

Link salary account as well as other bank accounts you use to showcase financial stability.

Request For a Limit Increase

If you meet eligibility, directly request a new limit within the app. You may be asked for added documents like bank statements, salary slips etc. which can help get approval faster.

Tips for Efficient Paytm Postpaid Usage

- Set reminders for statement due dates

- Avoid closing credit cards impacting credit mix

- Track repayments to ensure no delays

- Review usage patterns and adjust limits

Conclusion

Checking and increasing your Paytm Postpaid limit is now easy. Just ensure timely repayments, good credit health and sufficient eligibility before requesting an increased credit limit.

Using the higher limit sensibly allows you to reap benefits like greater purchasing power, financial management flexibility and strengthened credit.

FAQs:

What is the minimum Paytm Postpaid limit?

The minimum Paytm Postpaid limit set by the company is Rs. 5,000.

How much can I increase my Paytm Postpaid limit to?

You can request to increase your Paytm Postpaid limit up to Rs. 100,000 based on eligibility.

Does Paytm do a hard check when increasing limit?

No. Paytm relies primarily on internal analytics so increasing your limit only involves a soft credit check that does not impact your credit score.